Case Study Short Essay Examination Questions

A Real Options' Perspective on Microsoft's Dealings with Yahoo

In a bold move to transform two relatively weak online search businesses into a competitor capable of challenging market leader Google, Microsoft proposed to buy Yahoo for $44.6 billion on February 2, 2008. At $31 per share in cash and stock, the offer represented a 62 percent premium over Yahoo's prior day closing price. Despite boosting its bid to $33 per share to offset a decline in the value of Microsoft's share price following the initial offer, Microsoft was rebuffed by Yahoo's board and management. In early May, Microsoft withdrew its bid to buy the entire firm and substituted an offer to acquire the search business only. Incensed at Yahoo's refusal to accept the Microsoft bid, activist shareholder Carl Icahn initiated an unsuccessful proxy fight to replace the Yahoo board. Throughout this entire melodrama, critics continued to ask how Microsoft could justify an offer valued at $44.6 billion when the market prior to the announcement had valued Yahoo at only $27.5 billion.

Microsoft could have continued to slug it out with Yahoo and Google, as it has been for the last five years, but this would have given Google more time to consolidate its leadership position. Despite having spent billions of dollars on Microsoft's online service (Microsoft Network or MSN) in recent years, the business remains a money loser (with losses exceeding one half billion dollars in 2007). Furthermore, MSN accounted for only 5 percent of the firm's total revenue at that time.

Microsoft argued that its share of the online Internet search (i.e., ads appearing with search results) and display (i.e., website banner ads) advertising markets would be dramatically increased by combining Yahoo with MSN. Yahoo also is the leading consumer email service. Anticipated cost savings from combining the two businesses were expected to reach $1 billion annually. Longer term, Microsoft expected to bundle search and advertising capabilities into the Windows operating system to increase the usage of the combined firms' online services by offering compatible new products and enhanced search capabilities.

The two firms have very different cultures. The iconic Silicon Valley-based Yahoo often is characterized as a company with a free-wheeling, fun-loving culture, potentially incompatible with Microsoft's more structured and disciplined environment. Melding or eliminating overlapping businesses represents a potentially mind-numbing effort given the diversity and complexity of the numerous sites available. To achieve the projected cost savings, Microsoft would have to choose which of the businesses and technologies would survive. Moreover, the software driving all of these sites and services is largely incompatible.

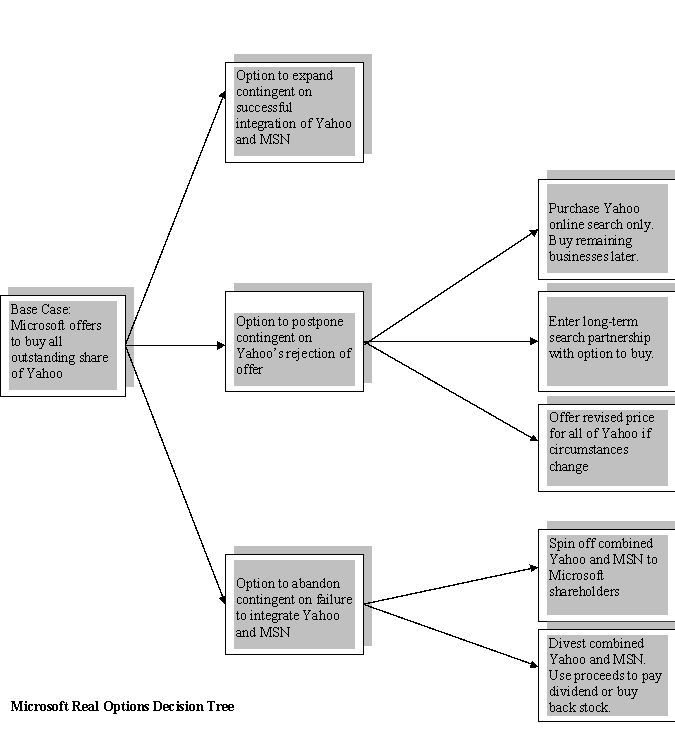

As an independent or stand-alone business, the market valued Yahoo at approximately $17 billion less than Microsoft's valuation. Microsoft was valuing Yahoo based on its intrinsic stand-alone value plus perceived synergy resulting from combining Yahoo and MSN. Standard discounted cash flow analysis assumes implicitly that, once Microsoft makes an investment decision, it cannot change its mind. In reality, once an investment decision is made, management often has a number of opportunities to make future decisions based on the outcome of things that are currently uncertain. These opportunities, or real options, include the decision to expand (i.e., accelerate investment at a later date), delay the initial investment, or abandon an investment. With respect to Microsoft's effort to acquire Yahoo, the major uncertainties dealt with the actual timing of an acquisition and whether the two businesses could be integrated successfully. For Microsoft's attempted takeover of Yahoo, such options included the following:

Base case. Buy 100 percent of Yahoo immediately.

Option to expand. If Yahoo were to accept the bid, accelerate investment in new products and services contingent on the successful integration of Yahoo and MSN.

Option to delay. (1) Temporarily walk away keeping open the possibility of returning for 100 percent of Yahoo if circumstances change, (2) offer to buy only the search business with the intent of purchasing the remainder of Yahoo at a later date, or (3) enter into a search partnership, with an option to buy at a later date.

Option to abandon. If Yahoo were to accept the bid, spin off or divest combined Yahoo/MSN if integration is unsuccessful.

The decision tree in the following exhibit illustrates the range of real options (albeit an incomplete list) available to the Microsoft board at that time. Each branch of the tree represents a specific option. The decision-tree framework is helpful in depicting the significant flexibility senior management often has in changing an existing investment decision at some point in the future.

With neither party making headway against Google, Microsoft again approached Yahoo in mid-2009, which resulted in an announcement in early 2010 of an internet search agreement between the two firms. Yahoo transferred control of its internet search technology to Microsoft in an attempt to boost its sagging profits. Microsoft is relying on a 10-year arrangement with Yahoo to help counter the dominance of Google in the internet search market. Both firms hope to be able to attract more advertising dollars paid by firms willing to pay for links on the firms' sites.  Case Study Short Essay Examination Questions

Case Study Short Essay Examination Questions

Merrill Lynch and BlackRock Agree to Swap Assets

During the 1990s, many financial services companies began offering mutual funds to their current customers who were pouring money into the then booming stock market. Hoping to become financial supermarkets offering an array of financial services to their customers, these firms offered mutual funds under their own brand name. The proliferation of mutual funds made it more difficult to be noticed by potential customers and required the firms to boost substantially advertising expenditures at a time when increased competition was reducing mutual fund management fees. In addition, potential customers were concerned that brokers would promote their own firm's mutual funds to boost profits.

This trend reversed in recent years, as banks, brokerage houses, and insurance companies are exiting the mutual fund management business. Merrill Lynch agreed on February 15, 2006, to swap its mutual funds business for an approximate 49 percent stake in money-manager BlackRock Inc. The mutual fund or retail accounts represented a new customer group for BlackRock, founded in 1987, which had previously managed primarily institutional accounts.

At $453 billion in 2005, BlackRock's assets under management had grown four times faster than Merrill's $544 billion mutual fund assets. During 2005, BlackRock's net income increased to $270 million, or 63 percent over the prior year, as compared to Merrill's 27 percent growth in net income in its mutual fund business to $397 million. BlackRock and Merrill stock traded at 30 and 19 times estimated 2006 earnings, respectively.

Merrill assets and net income represented 55 percent and 60 percent of the combined BlackRock and Merrill assets and net income, respectively. Under the terms of the transaction, BlackRock would issue 65 million new common shares to Merrill. Based on BlackRock's February 14, 2005, closing price, the deal is valued at $9.8 billion. The common stock gave Merrill 49 percent of the outstanding BlackRock voting stock. PNC Financial and employees and public shareholders owned 34 percent and 17 percent, respectively. Merrill's ability to influence board decisions is limited, since it has only 2 of 17 seats on the BlackRock board of directors. Certain "significant matters" require a 70 percent vote of all board members and 100 percent of the nine independent members, which include the two Merrill representatives. Merrill (along with PNC) must also vote its shares as recommended by the BlackRock board.

-What method of accounting would Merrill use to show its investment in BlackRock?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: What alternative valuation methods could Google have

Q77: To what extent might the use of

Q81: Case Study Short Essay Examination Questions

A Real

Q82: Case Study Short Essay Examination Questions

Valuation Methods

Q82: Which of the following statements about the

Q84: Which of the following represent options available

Q85: Which of the following is not true

Q87: Which one of the following is not

Q98: Which of the following is not true

Q104: Valuation Methods Employed in Investment Bank

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents