Pollek Corporation paid $16,200 for a 90% interest in Swamp Corporation on January 1,2011,when Swamp stockholders' equity consisted of $10,000 Capital Stock and $3,000 of Retained Earnings.The excess cost over book value was attributable to goodwill.

Additional information:

1.Pollek sells merchandise to Swamp at 120% of Pollek's cost.During 2011,Pollek's sales to Swamp were $4,800,of which half of the merchandise remained in Swamp's inventory at December 31,2011.(The 2011 ending inventory was sold in 2012. )During 2012,Pollek's sales to Swamp were $6,000 of which 60% remained in Swamp's inventory at December 31,2012.At year-end 2012,Swamp owed Pollek $1,500 for the inventory purchased during 2012.

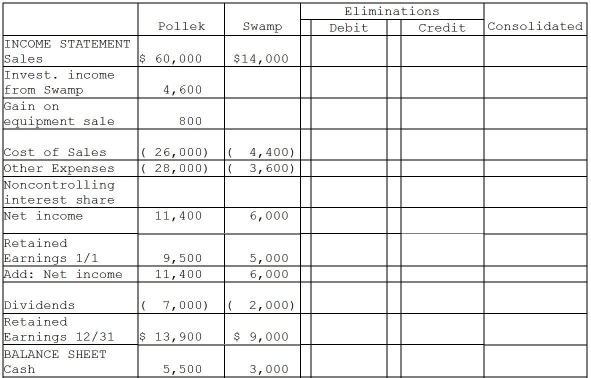

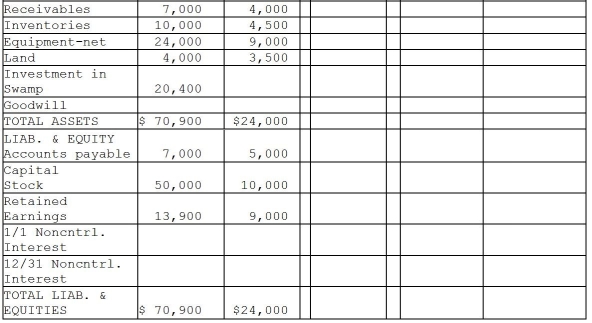

2.Pollek Corporation sold equipment with a book value of $2,000 and a remaining useful life of four years and no salvage value to Swamp Corporation on January 1,2012 for $2,800.Straight-line depreciation is used.

3.Separate company financial statements for Pollek Corporation and Subsidiary at December 31,2012 are summarized in the first two columns of the consolidation working papers.

4.The following information is available for 2011:

Required:

Required:

Complete the working papers to consolidate the financial statements of Pollek Corporation and subsidiary for the year ended December 31,2012.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Several years ago,Pilot International purchased 70% of

Q23: Plower Corporation acquired all of the outstanding

Q24: On January 2,2012,Pal Corporation sold warehouse equipment

Q25: Snow Company is a wholly owned subsidiary

Q26: Palmer Corporation purchased 75% of Stone Industries'

Q28: Prey Corporation created a wholly owned subsidiary,Sage

Q29: On January 1,2011,Pilgrim Imaging purchased 90% of

Q31: Piglet Incorporated purchased 90% of the outstanding

Q32: Pierce Manufacturing owns all of the outstanding

Q35: Several years ago,Peacock International purchased 80% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents