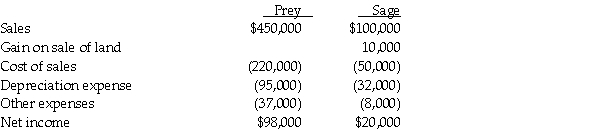

Prey Corporation created a wholly owned subsidiary,Sage Corporation,on January 1,2010,at which time Prey sold land with a book value of $90,000 to Sage at its fair market value of $140,000.Also,on January 1,2010,Prey sold to Sage equipment with a book value of $130,000 and a selling price of $165,000.The equipment had a remaining useful life of 4 years and is being depreciated under the straight-line method.The equipment has no salvage value.On January 1,2012,Sage resold the land to an outside entity for $150,000.Sage continues to use the equipment purchased from Prey.Income statements for Prey and Sage for the year ended December 31,2012 are summarized below:

Required:

Required:

At what amounts did the following items appear on the consolidated income statement for Prey and Subsidiary for the year ended December 31,2012?

1.Gain on Sale of Land

2.Depreciation Expense

3.Consolidated net income

4.Controlling interest share of consolidated net income

Correct Answer:

Verified

The gain on the sale of th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Plower Corporation acquired all of the outstanding

Q24: On January 2,2012,Pal Corporation sold warehouse equipment

Q25: Snow Company is a wholly owned subsidiary

Q26: Palmer Corporation purchased 75% of Stone Industries'

Q27: Pollek Corporation paid $16,200 for a 90%

Q29: On January 1,2011,Pilgrim Imaging purchased 90% of

Q31: Piglet Incorporated purchased 90% of the outstanding

Q32: Pierce Manufacturing owns all of the outstanding

Q33: Plock Corporation,the 75% owner of Seraphim Company,reported

Q35: Several years ago,Peacock International purchased 80% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents