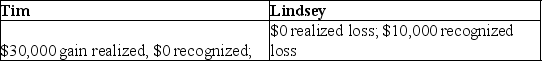

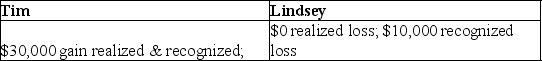

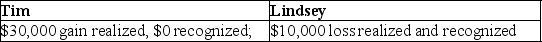

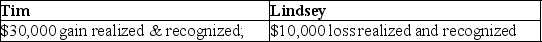

Star Corporation,in complete liquidation,makes distributions to its two shareholders.Tim surrenders his Star stock (adjusted basis of $70,000) to the corporation in exchange for land with a $90,000 adjusted basis and a $100,000 FMV.Lindsey receives $100,000 cash for her shares (adjusted basis $110,000) .What is the amount of gains and or losses recognized by Tim and Lindsey as a result of these transactions?

A)

B)

C)

D)

Correct Answer:

Verified

Q94: Blue Corporation distributes land and building having

Q104: A liquidating corporation

A)recognizes gains and losses on

Q107: A corporation distributes land with a FMV

Q116: A corporation is owned 70% by Jones

Q123: Lafayette Corporation distributes $80,000 in cash along

Q131: Pursuant to a complete liquidation,Southern Electric Corporation

Q132: Tester Corporation acquired all of the stock

Q134: Ten years ago Finn Corporation formed a

Q135: A corporation distributes land worth $200,000 to

Q1394: Discuss the tax consequences of a complete

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents