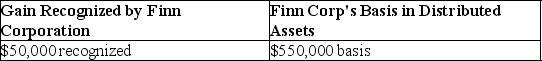

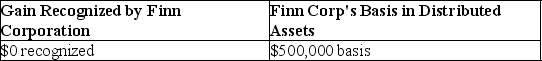

Ten years ago Finn Corporation formed a new 100 percent owned subsidiary,Wing Corporation,with a $500,000 investment.Wing Corporation is completely liquidated this year,with all assets distributed to Finn Corporation.As of the liquidation date,Wing has a basis in its assets of $350,000,and the assets are valued at $550,000.What is the gain or loss recognized by Finn Corporation due to the liquidating distribution,and what is Finn Corporation's basis in the assets received from Wing Corporation?

A)

B)

C)

D)

Correct Answer:

Verified

Q94: Blue Corporation distributes land and building having

Q101: Corkie Corporation distributes $80,000 cash along with

Q104: A liquidating corporation

A)recognizes gains and losses on

Q107: A corporation distributes land with a FMV

Q113: A shareholder receives a distribution from a

Q115: A corporation is owned 70% by Jones

Q123: Lafayette Corporation distributes $80,000 in cash along

Q131: Star Corporation,in complete liquidation,makes distributions to its

Q131: Pursuant to a complete liquidation,Southern Electric Corporation

Q135: A corporation distributes land worth $200,000 to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents