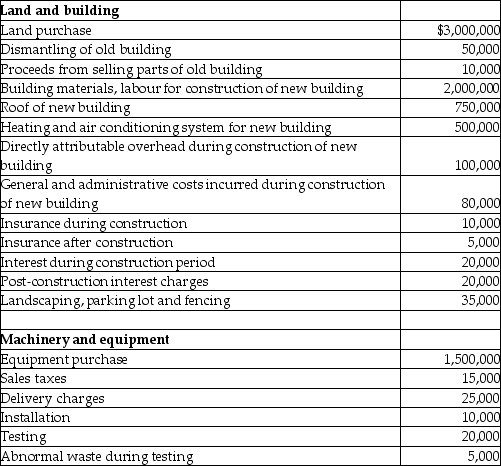

Growth Industries incurred the following costs in fiscal 2011:

Additional information:

Additional information:

•Growth Industries estimates that future site restoration of $1 million will be required in 20 years at an interest rate of 8%.

•While the equipment has a useful life of 10 years, the engine in the equipment will require replacement in 3 years. The engine has a fair value of $150,000.

•The landscaping, parking lot and fences will need to be replaced every 4 years.

•The useful life of the building and roof will be 20 years. The heating and air conditioning system will have a useful life of only 10 years.

Required:

a)Determine how much should be capitalized to property, plant and equipment.

b)Provide the journal entries required to record all of these transactions.

c)Provide all the adjusting journal entries required at year end for fiscal 2011.

d)Assume that the building is painted in fiscal 2012 at a cost of $45,000. Prepare the required journal entry.

e)Assume that the engine for the machine requires replacing after 2 years at a cost of 125,000. Prepare the required journal entries.

Round all values to the nearest dollar, if necessary.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Will the method of depreciation affect the

Q111: Ronald exchanged similar assets with Silver Company

Q116: The following entry was recorded by Alex

Q118: Francisco purchased a machine on Jan 1,

Q119: A machine was purchased during 2013 for

Q122: In December 2013, Bea, the owner of

Q123: The following transactions occurred in fiscal 2012:

•Synthesize

Q124: On March 31, 2013, a machine costing

Q125: Grape Company (GC)had been renting an office

Q126: Aye Corp acquired land and a building

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents