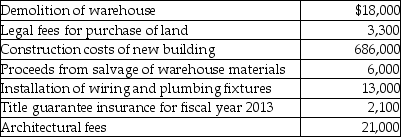

Grape Company (GC)had been renting an office building for several years. On January 1, 2013, GC decided to have a new office building constructed. On that date, it acquired land with an abandoned warehouse on it for $350,000. Other costs included the following:

Required:

Required:

a. Calculate at what amount GC should record the (i)land and (ii)building.

b. Assume that the building was completed and occupied on December 31, 2013. It has an estimated useful life of 40 years, with residual value of $140,000. Calculate depreciation for 2014 using (i)the straight-line method and (ii)the double declining balance method.

c. Assume that management decided to use straight-line depreciation for the building. By 2017 GC had

grown considerably and needed to relocate for more space; it sold the land and building to Macaw Company on July 1, 2017 for $1,350,000. Assume depreciation expense has already been recorded for the first six months of the year (Jan. 1, 2017 to June 30, 2017). Prepare all journal entries required relating to the land and building accounts on July 1, 2017.

Correct Answer:

Verified

Straight-line de...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Will the method of depreciation affect the

Q111: Ronald exchanged similar assets with Silver Company

Q118: Francisco purchased a machine on Jan 1,

Q119: A machine was purchased during 2013 for

Q121: Growth Industries incurred the following costs in

Q122: In December 2013, Bea, the owner of

Q123: The following transactions occurred in fiscal 2012:

•Synthesize

Q124: On March 31, 2013, a machine costing

Q126: Aye Corp acquired land and a building

Q127: On March 31, 2013, a machine costing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents