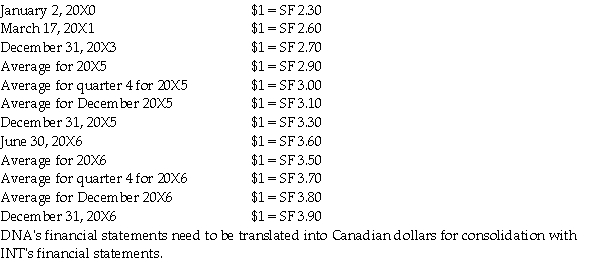

DNA was incorporated on January 2,20X0 and commenced active operations immediately.Common shares were issued on the date of incorporation and no new common shares have been issued since then.On December 31,20X3,INT purchased 70% of the outstanding common shares of DNA for 800,000 Swiss francs (CHF).

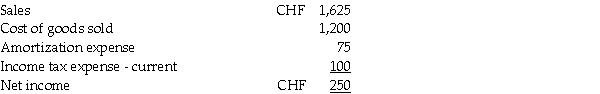

DNA's main operations are located in Switzerland.For the year ending December 31,20X6,the income statement (in 000s)for DNA was as follows:

The comparative and condensed statements of financial position (in 000s)for DNA were as follows:

OTHER INFORMATION:

• Purchases and sales of merchandise inventory occurred evenly throughout the year.

• The ending inventory was purchased evenly throughout the last month of the year.

• DNA had purchased the capital assets on hand at the end of 20X6 on March 17,20X1.There were no purchases or sales of capital assets from 20X3 to 20X6.

• Dividends were paid on June 30,20X6.

Assume that foreign exchange rates were as follows:

Required:

Translate DNA's balance sheet (excluding retained earnings)at December 31,20X6 into Canadian dollars under the temporal method.

Correct Answer:

Verified

Q22: All of the following statements are stated

Q23: Which translation method should be used for

Q24: Water Bottling Inc.(WBI)is a 100% wholly owned

Q26: Water Bottling Inc.(WBI)is a 100% wholly owned

Q28: Under the temporal method,how is an exchange

Q29: For consolidation purposes, what exchange rate is

Q29: Liverpool Company operates retail stores in Canada

Q30: Under the temporal method,at what exchange rate

Q32: For publicly accountable companies, with foreign operations

Q32: Liverpool Company operates retail stores in Canada

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents