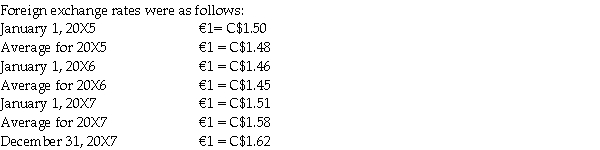

Water Bottling Inc.(WBI)is a 100% wholly owned subsidiary with operations in France.WBI was purchased by a Canadian parent on January 1,20X5.The financial records of WBI are maintained in euros and provide the following information with respect to equipment,intangibles and goodwill.

Equipment - purchased on January 1,20X5 for €250,000 - depreciated over 5 years on a straight-line basis.

Equipment - purchased on January 1,20X6 for €175,000 - depreciated over 5 years on a straight-line basis.

Required:

Assume that WBC's functional currency is the Canadian dollar.Calculate the translated Canadian dollar balances for the following accounts for December 31,20X7

a.Equipment

b.Accumulated depreciation - equipment

c.Depreciation expense

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: When it is not clear what the

Q20: All of the following statements are stated

Q21: Under the current-rate method,what is the accounting

Q22: All of the following statements are stated

Q23: Which translation method should be used for

Q26: Water Bottling Inc.(WBI)is a 100% wholly owned

Q27: DNA was incorporated on January 2,20X0 and

Q28: Under the temporal method,how is an exchange

Q29: For consolidation purposes, what exchange rate is

Q29: Liverpool Company operates retail stores in Canada

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents