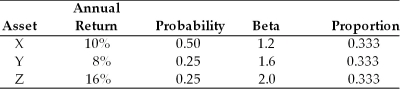

Table 8.2

You are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows:

-What is Nico's portfolio beta if he invests an equal amount in asset X with a beta of 0.60, asset Y with a beta of 1.60, the risk-free asset, and the market portfolio?

A) 1.20

B) 1.00

C) 0.80

D) 0.60

Correct Answer:

Verified

Q140: Risk that affects all firms is called

A)

Q141: Tangshan Antiques has a beta of 1.40,

Q144: The beta coefficient is an index that

Q146: Table 8.2

You are going to invest $20,000

Q147: Table 8.3

Consider the following two securities X

Q148: Table 8.2

You are going to invest $20,000

Q148: Table 8.3

Consider the following two securities X

Q150: Table 8.3

Consider the following two securities X

Q152: As randomly selected securities are combined to

Q156: Table 8.2

You are going to invest $20,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents