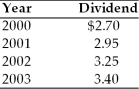

Tangshan Antiques has a beta of 1.40, the annual risk-free rate of interest is currently 10 percent, and the required return on the market portfolio is 16 percent. The firm estimates that its future dividends will continue to increase at an annual compound rate consistent with that experienced over the 2000-2003 period.  (a) Estimate the value of Tangshan Antiques stock.

(a) Estimate the value of Tangshan Antiques stock.

(b) A lawsuit has been filed against the company by a competitor, and the potential loss has increased risk, which is reflected in the company's beta, increasing it to 1.6. What is the estimated price of the stock following the filing of the lawsuit.

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: The higher an asset's beta, _.

A) the

Q127: The purpose of adding an asset with

Q136: An investment banker has recommended a $100,000

Q138: Event risk is the chance that a

Q140: Risk that affects all firms is called

A)

Q144: The beta coefficient is an index that

Q145: Table 8.2

You are going to invest $20,000

Q146: Table 8.2

You are going to invest $20,000

Q152: As randomly selected securities are combined to

Q156: Table 8.2

You are going to invest $20,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents