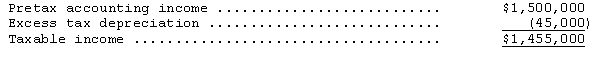

The following information is taken from Glenville Corporation's 2014 financial records:

Assume the taxable temporary difference was created entirely in 2014 and will reverse in equal net taxable amounts in each of the next three years.If tax rates are 40 percent in 2014,35 percent in 2015,35 percent in 2016,and 30 percent in 2017,then the total deferred tax liability Glenville should report on its December 31,2014,balance sheet is

A) $13,500.

B) $15,000.

C) $15,750.

D) $18,000.

Correct Answer:

Verified

Q22: In 2014,The Xavier Company,reported pretax financial income

Q26: The Racing Company had taxable income of

Q27: On the statement of cash flows using

Q32: Historically,the United Kingdom has recognized only those

Q33: The following information was taken from Caribbean

Q34: International accounting standards currently are moving toward

Q35: Hagar Corporation reported depreciation of $250,000 on

Q36: The Morris Corporation reported a $59,000 operating

Q37: Amengual Corporation began operations in 2011 and

Q39: Garden Company had pretax accounting income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents