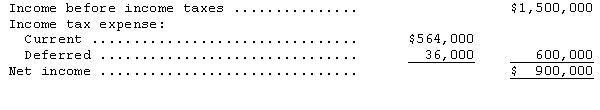

The following information was taken from Caribbean Corporation's 2014 income statement:

Caribbeans' first year of operations was 2014.The company has a 30 percent tax rate.Management decided to use accelerated depreciation for tax purpose and the straight-line method of depreciation for financial reporting purposes.The amount charged to depreciation expense in 2014 was $600,000.Assuming no other differences existed between book income and taxable income,what amount did Caribbean deduct for depreciation on its tax return for 2014?

A) $480,000

B) $570,000

C) $600,000

D) $720,000

Correct Answer:

Verified

Q22: In 2014,The Xavier Company,reported pretax financial income

Q26: The Racing Company had taxable income of

Q27: On the statement of cash flows using

Q32: Historically,the United Kingdom has recognized only those

Q34: The following information is taken from Glenville

Q35: Hagar Corporation reported depreciation of $250,000 on

Q36: The Morris Corporation reported a $59,000 operating

Q37: Amengual Corporation began operations in 2011 and

Q39: Garden Company had pretax accounting income of

Q40: The asset-liability method of interperiod tax allocation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents