Grisoft Inc.computed a pretax financial income of $40,000 for the first year of its operations ended December 31,2014.Analysis of the tax and book basis of its liabilities disclosed $360,000 in unearned rent revenue on the books that had been recognized as taxable income in 2014 when the cash was received.

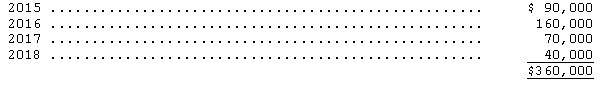

The unearned rent is expected to be recognized on the books in the following pattern:

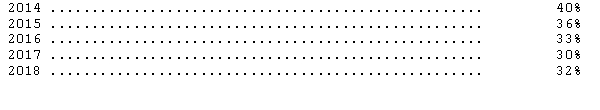

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No.109.

(1)Prepare a schedule showing the reversal of the temporary difference and the computation of income taxes payable and deferred tax assets or liabilities as of December 31,2014.

(2)Prepare journal entries to record income taxes payable and deferred income taxes.

(3)Prepare the income statement for Grisoft beginning with "Income from continuing operations before income taxes" for the year ended December 31,2014.

Correct Answer:

Verified

Q46: For the current year,Phoenix Company reported income

Q54: Which of the following is NOT a

Q56: Which of the following represents a permanent

Q58: Creative Corporation's income statement for the year

Q61: The application of SFAS No.109 results in

Q63: Bailey Company has a deferred tax asset

Q64: The statutory federal tax rate of Yolanda

Q65: The Internal Revenue Code allows a corporation

Q66: Many non-accountants are confused when they hear

Q67: The notes to the 2014 financial statements

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents