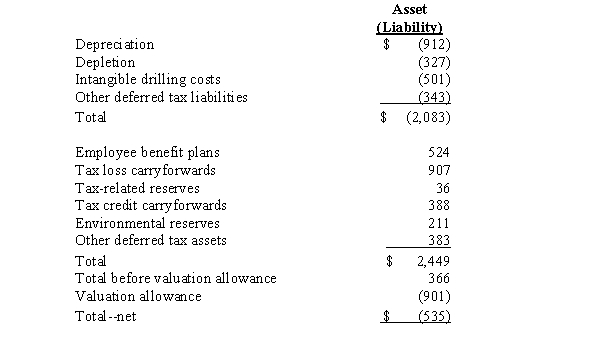

The notes to the 2014 financial statements of Halvoline Oil Company provide the following disclosure regarding the deferred tax asset and liability accounts at December 31,2014 (amounts in millions of dollars):

Required:

1.What is the total amount of deferred liability at December 31,2014? What is the total amount of deferred tax asset? What is the net amount of the deferred tax asset or liability?

2.Assuming a federal tax rate of 35 percent,estimate the temporary difference arising from depreciation that exists for Halvoline at December 31,2014.

3.On December 31,2014,Halvoline shows a noncurrent liability on its balance sheet,captioned "deferred income taxes",in the amount of $634 million.What other deferred tax account,if any is included in the balance sheet? What is the amount of this other deferred tax account?

Correct Answer:

Verified

Q62: Grisoft Inc.computed a pretax financial income of

Q62: Pretax accounting income is $100,000 and the

Q63: Bailey Company has a deferred tax asset

Q64: The statutory federal tax rate of Yolanda

Q65: The Internal Revenue Code allows a corporation

Q66: Many non-accountants are confused when they hear

Q68: Smart Services computed pretax financial income of

Q69: A major conceptual issue associated with interperiod

Q70: The accounting profession has wrestled for many

Q71: Myerson Company reported taxable income of $60,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents