Seymour Associates computed a pretax financial income of $280,000 for the first year of its operations ended December 31,2014.Included in financial income was $20,000 of nondeductible expense and $70,000 gross profit on installment sales that was deferred for tax purposes until the installments were collected.

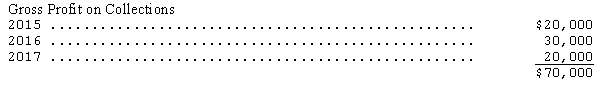

The temporary differences are expected to reverse in the following pattern.

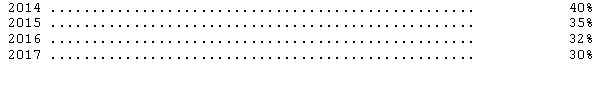

The enacted tax rates for this year and the next three years are as follows:

(1)Prepare a schedule showing the reversal of the temporary differences and the computation of income taxes payable and deferred tax assets or liabilities as of December 31,2014.

(2)Prepare journal entries to record income taxes payable and deferred income taxes.

(3)Prepare the income statement for Seymour beginning with "Income from continuing operations before income taxes" for the year ended December 31,2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: A major conceptual issue regarding the accounting

Q75: Oriole Industries computed a pretax financial income

Q76: The following differences between financial and taxable

Q77: Allsgood Appliances computed a pretax financial loss

Q78: Eva Designs,Inc.,a corporation organized on January 1,2005,reported

Q80: Mostel Company has each of the following

Q81: SFAS No.109 uses the term "tax-planning strategy".The

Q82: The Montoya Corporation reports the following differences

Q83: Eastwood Manufacturing planned to claim a $10,000

Q84: SFAS No 109 takes a decidedly different

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents