Eastwood Manufacturing planned to claim a $10,000 credit for increasing research activities (an R & D credit)on its 2014 income tax return.Although some portion of the credit is at risk,management believes that it is "more likely than not" that the reporting entity will qualify for all or a portion of the R & D credit.As a result,recognition will be limited to only a portion of the amount claimed on the Company's income tax return.

Given that the credit meets the more-likely-than-not threshold,management must measure

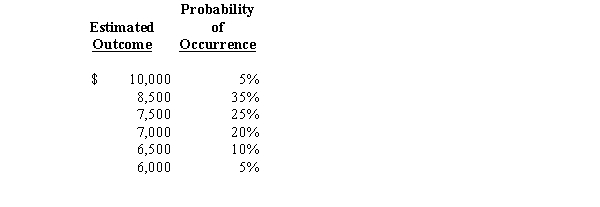

the amount to be recognized.Accordingly,management has estimated the range of possible outcomes regarding the amount of the credit to be allowed,and the related likelihoods,as follows:

Required:

1.Determine the amount of the tax position that would be recognized in Eastwood Manufacturing's financial statements.

2.Determine the amount of the liability for unrecognized income tax benefits that would appear on Eastwood Manufacturing's balance sheet.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Allsgood Appliances computed a pretax financial loss

Q78: Eva Designs,Inc.,a corporation organized on January 1,2005,reported

Q79: Seymour Associates computed a pretax financial income

Q80: Mostel Company has each of the following

Q81: SFAS No.109 uses the term "tax-planning strategy".The

Q82: The Montoya Corporation reports the following differences

Q84: SFAS No 109 takes a decidedly different

Q85: SFAS No.109 rejected the approach of its

Q86: IAS No.12,"Income Taxes," contains the provisions relating

Q87: SFAS No.109 allows the recognition of deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents