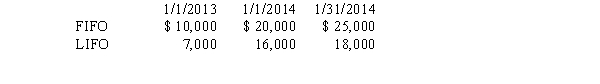

A retailing firm changed from LIFO to FIFO in 2014. Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,choose the following:

1.The correct amount in the 2014 entry to record the accounting principle change

2.Whether the entry affects 2014 earnings or is recorded as an adjustment to retained earnings (RE)

3.The 2014 cost of goods sold

Correct Answer:

Verified

Q62: Which of the following is not a

Q63: Ideally,managers should make accounting changes only as

Q64: Sandusky Enterprise purchased a machine on January

Q66: A retailing firm changed from LIFO to

Q66: Elder Corporation decided to change its depreciation

Q68: In 2014,a company discovered that $20,000 of

Q70: Since its organization on January 1,2012,Virginia Inc.failed

Q71: Improved Technologies has estimated bad debts using

Q74: Chiclet Company decides at the beginning of

Q74: On January 1,2011,Shine Services Inc.purchased a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents