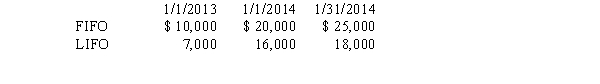

A retailing firm changed from LIFO to FIFO in 2014. Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold?

Correct Answer:

Verified

Q61: In reviewing the books of Unger Retailers

Q62: Which of the following is not a

Q62: Managers often are accused of making accounting

Q63: Ideally,managers should make accounting changes only as

Q64: Sandusky Enterprise purchased a machine on January

Q67: For a company with a periodic inventory

Q68: In 2014,a company discovered that $20,000 of

Q69: A retailing firm changed from LIFO to

Q70: Since its organization on January 1,2012,Virginia Inc.failed

Q71: Improved Technologies has estimated bad debts using

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents