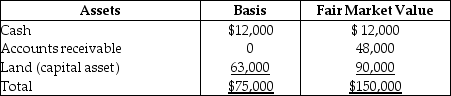

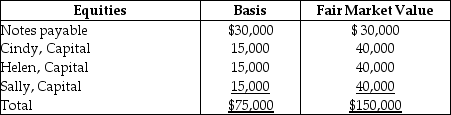

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable.Her basis for the partnership interest before any distribution is $25,000.What gain/loss should she report for tax purposes?

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable.Her basis for the partnership interest before any distribution is $25,000.What gain/loss should she report for tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Jerry has a $50,000 basis for his

Q41: What is included in the definition of

Q74: The Tandy Partnership owns the following assets

Q83: Tony sells his one-fourth interest in the

Q84: On December 31,Kate sells her 20% interest

Q85: When must a partnership make mandatory basis

Q89: Patrick purchased a one-third interest in the

Q93: Which of the following is valid reason

Q94: Which of the following statements is correct?

A)A

Q106: The limited liability company (LLC)has become a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents