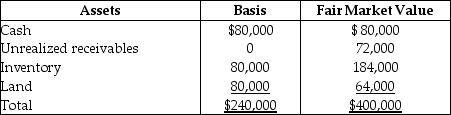

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the amount of gain realized by Tony on the sale of his partnership interest?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the amount of gain realized by Tony on the sale of his partnership interest?

Correct Answer:

Verified

Q40: Jerry has a $50,000 basis for his

Q41: What is included in the definition of

Q58: Eicho's interest in the DPQ Partnership is

Q79: The CHS Partnership's balance sheet presented below

Q84: On December 31,Kate sells her 20% interest

Q85: Tony sells his one-fourth interest in the

Q87: The HMS Partnership,a cash method of accounting

Q88: Sean,Penelope,and Juan formed the SPJ partnership by

Q93: Which of the following is valid reason

Q106: The limited liability company (LLC)has become a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents