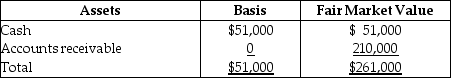

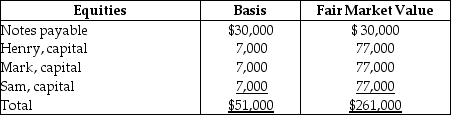

The HMS Partnership,a cash method of accounting entity,has the following balance sheet at December 31 of last year:

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: Eicho's interest in the DPQ Partnership is

Q64: Joshua is a 40% partner in the

Q68: What is the character of the gain/loss

Q80: Can a partner recognize both a gain

Q83: Tony sells his one-fourth interest in the

Q84: On December 31,Kate sells her 20% interest

Q85: Tony sells his one-fourth interest in the

Q88: Sean,Penelope,and Juan formed the SPJ partnership by

Q104: All states have adopted laws providing for

Q106: The limited liability company (LLC)has become a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents