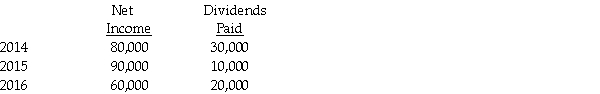

On January 1,2014,Paisley Incorporated paid $300,000 for 60% of Smarnia Company's outstanding capital stock.Smarnia reported common stock on that date of $250,000 and retained earnings of $100,000.Plant assets,which had a five-year remaining life,were undervalued in Smarnia's financial records by $10,000.Smarnia also had a patent that was not on the books,but had a market value of $60,000.The patent has a remaining useful life of 10 years.Any remaining fair value/book value differential is allocated to goodwill.Smarnia's net income and dividends paid the first three years that Paisley owned them are shown below.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia,calculate the ending balance in the Investment in Smarnia account for each of the three years.

Correct Answer:

Verified

Q28: On January 1,2014,Persona Company acquired 80% of

Q29: Pecan Incorporated acquired 80% of the voting

Q30: On December 31,2014,Patenne Incorporated purchased 60% of

Q31: On December 31,2014,Paladium International purchased 70% of

Q32: Puddle Corporation acquired all the voting stock

Q33: Pennack Corporation purchased 75% of the outstanding

Q35: Pommu Corporation paid $78,000 for a 60%

Q36: Flagship Company has the following information collected

Q37: Pull Incorporated and Shove Company reported summarized

Q38: On January 2,2014,Paleon Packaging purchased 90% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents