On December 31,2014,Patenne Incorporated Purchased 60% of Smolin Manufacturing for $300,000.The

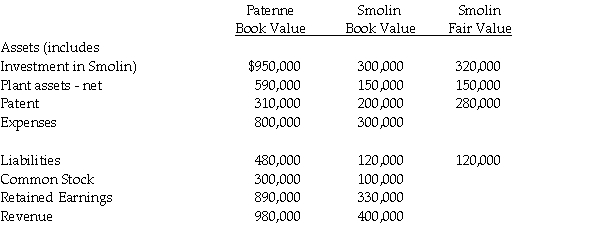

On December 31,2014,Patenne Incorporated purchased 60% of Smolin Manufacturing for $300,000.The book value and fair value of Smolin's assets and liabilities were equal with the exception of plant assets which were undervalued by $60,000 and had a remaining life of 10 years,and a patent which was undervalued by $40,000 and had a remaining life of 5 years.At December 31,2016,the companies showed the following balances on their respective adjusted trial balances:

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2016.

Requirement 2: Calculate consolidated net income for 2016,and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31,2016.

Correct Answer:

Verified

Q25: Platt Corporation paid $87,500 for a 70%

Q26: Parrot Corporation acquired 90% of Swallow Co.on

Q28: On January 1,2014,Persona Company acquired 80% of

Q29: Pecan Incorporated acquired 80% of the voting

Q31: On December 31,2014,Paladium International purchased 70% of

Q32: Puddle Corporation acquired all the voting stock

Q33: Pennack Corporation purchased 75% of the outstanding

Q34: On January 1,2014,Paisley Incorporated paid $300,000 for

Q35: Pommu Corporation paid $78,000 for a 60%

Q38: On January 2,2014,PBL Enterprises purchased 90% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents