Use the following information to answer the question(s)below.

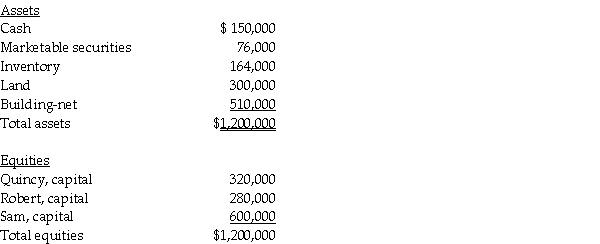

Quincy has decided to retire from the partnership of Quincy,Robert,and Sam.The partnership will pay Quincy $400,000.Total partnership capital should be revalued based on the excess payment to Quincy.(Assume the book values of the assets listed below equals fair values . )A summary balance sheet for the Quincy,Robert,and Sam partnership appears below.Quincy,Robert,and Sam share profits and losses in a ratio of 1:1:3,respectively.

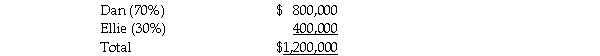

-Dan and Ellie share partnership profits and losses at 70% and 30%,respectively.The partners agree to admit Fran into the partnership for a 50% interest in capital and earnings.Capital accounts immediately before the admission of Fran are:

Required:

1.Prepare the journal entry(s)for the admission of Fran to the partnership assuming Fran invested $800,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Fran paid the money directly to Dan and to Ellie for 50% of each of their respective capital interests.The partnership records goodwill.

2.Prepare the journal entry(s)for the admission of Fran to the partnership assuming Fran invested $1,000,000 for the ownership interest.Fran paid the money to the partnership for a 50% interest in capital and earnings.Assume the valuation is based on the capital of the current partnership,which is fairly valued.The partnership records goodwill.

3.Prepare the journal entry(s)for the admission of Fran to the partnership assuming Fran invested $1,400,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Fran paid the money to the partnership for a 50% interest in capital and earnings.The partnership records goodwill.

Correct Answer:

Verified

If an $800,000 payment r...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: On July 1,2014,Joe,Kline,and Lama began a partnership

Q26: Daniel,Ethan,and Frank have a retail partnership business

Q29: A summary balance sheet for the Akerly,Baskin,and

Q29: The profit and loss sharing agreement for

Q30: Required:

1.Prepare a schedule to allocate income to

Q32: A summary balance sheet for the partnership

Q33: Greta,Harriet,and Ivy have a retail partnership business

Q34: On February 1,2014,George,Hamm,and Ishmael began a partnership

Q36: The Leo,Mark and Natalie Partnership had the

Q38: Required:

1.Prepare a schedule to allocate income or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents