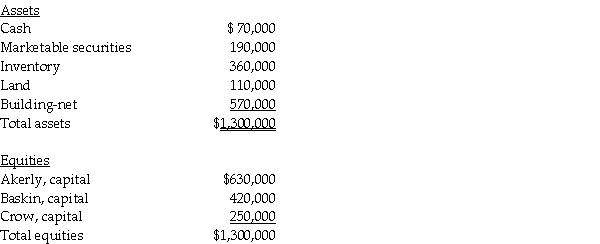

A summary balance sheet for the Akerly,Baskin,and Crow partnership on December 31,2014 is shown below.Partners Akerly,Baskin,and Crow allocate profit and loss in their respective ratios of 3:2:1.The partnership agreed to pay partner Baskin $500,000 for his partnership interest upon his retirement from the partnership on January 1,2015.The partnership financials on January 1,2015 are:

Required:

Prepare the journal entry to reflect Baskin's retirement from the partnership:

1.Assuming a bonus to Baskin.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Correct Answer:

Verified

Akerly and Crow give a bon...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: A summary balance sheet for the Ash,Brown,and

Q26: Daniel,Ethan,and Frank have a retail partnership business

Q26: On July 1,2014,Joe,Kline,and Lama began a partnership

Q30: Required:

1.Prepare a schedule to allocate income to

Q31: Use the following information to answer the

Q32: Required:

1.Prepare a schedule to allocate income or

Q32: A summary balance sheet for the partnership

Q33: Greta,Harriet,and Ivy have a retail partnership business

Q34: On February 1,2014,George,Hamm,and Ishmael began a partnership

Q38: Required:

1.Prepare a schedule to allocate income or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents