Rockaway Company produces two types of product, flat and round, on the same production line. For the current period, the company reports the following data.

Rockaway's controller wishes to apply activity-based costing (ABC) to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above. She has collected the following information.

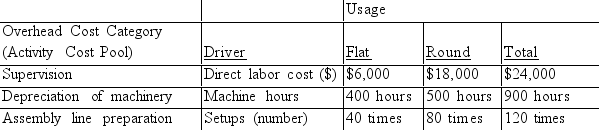

She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines.

Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: The Homer Corporation produces two products, and

Q61: Cleveland Company manufactures two products, Product

Q62: Dover Company manufactures two products, Product

Q63: Bangor Company manufactures two products, Product

Q64: Melbourne Resources provides the following data to

Q65: A _ is a factor that causes

Q66: Under traditional cost allocation methods, low-volume complex

Q67: Rockaway Company produces two types of

Q68: Stormer Corporation has provided the following

Q69: An activity _ is a temporary account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents