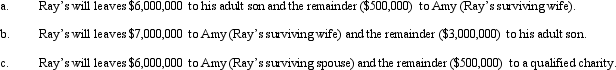

In each of the following independent situations, describe the effect of the disclaimer procedure on Ray's taxable estate. In this regard, advise as to how much should be disclaimed, by whom, and whether a disclaimer should be made, for the death in 2011.

Correct Answer:

Verified

Q89: Zane makes a gift of stock in

Q106: One of the objectives of establishing a

Q112: How can a disclaimer by an heir

Q132: What are the advantages of § 6166

Q135: Robert and Kristen are husband and wife.

Q137: In terms of future estate tax (and

Q138: If the special use valuation method of

Q139: In making a choice as to which

Q142: In planning for the use of §

Q144: Brooke wants to donate a parcel of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents