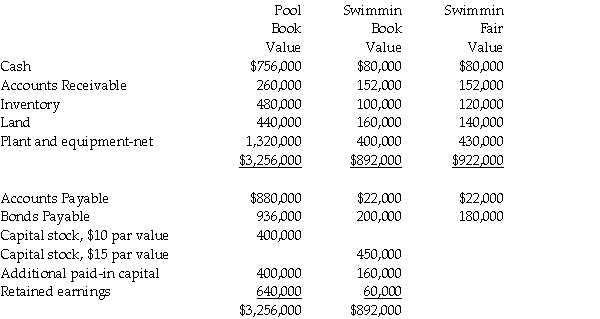

Pool Industries paid $540,000 to purchase 75% of the outstanding stock of Swimmin Corporation, on December 31, 2014. Any excess fair value over the identified assets and liabilities is attributed to goodwill. The following year-end information was available just before the purchase:

Using the data provided above, assume that Pool decided rather than paying $540,000 cash, Pool issued 10,000 shares of their own stock to the owners of Swimmin. At the time of issue, the $10 par value stock had a market value of $60 per share.

Using the data provided above, assume that Pool decided rather than paying $540,000 cash, Pool issued 10,000 shares of their own stock to the owners of Swimmin. At the time of issue, the $10 par value stock had a market value of $60 per share.

Required: Prepare Pool's consolidated balance sheet on December 31, 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: On July 1,2014,Polliwog Incorporated paid cash for

Q29: Passcode Incorporated acquired 90% of Safe Systems

Q30: Pamula Corporation paid $279,000 for 90% of

Q31: On January 1, 2014, Pinnead Incorporated paid

Q33: Pattalle Co purchases Senday, Inc. on January

Q34: Pal Corporation paid $5,000 for a 60%

Q35: On January 2, 2014, Power Incorporated paid

Q36: Petra Corporation paid $500,000 for 80% of

Q37: On January 1, 2014, Myna Corporation issued

Q38: Patterson Company acquired 90% of Starr Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents