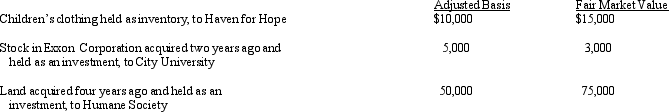

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction?

How much qualifies for the charitable contribution deduction?

A) $63,000.

B) $65,000.

C) $90,500.

D) $92,500.

E) None of the above.

Correct Answer:

Verified

Q65: Which of the following statements is correct

Q65: Which of the following statements is incorrect

Q66: During 2012, Sparrow Corporation, a calendar year

Q66: Emerald Corporation, a calendar year C corporation,

Q70: Grebe Corporation, a closely held corporation that

Q71: Hippo, Inc., a calendar year C corporation,

Q75: Which of the following statements is incorrect

Q76: George Judson is the sole shareholder and

Q80: Copper Corporation owns stock in Bronze Corporation

Q80: Robin Corporation, a calendar year C corporation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents