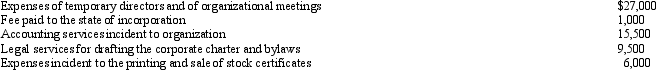

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2012. The following expenses were incurred during the first tax year (April 1 through December 31, 2012) of operations:  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

A) $0.

B) $4,550.

C) $5,000.

D) $7,400.

E) None of the above.

Correct Answer:

Verified

Q61: During the current year, Kingbird Corporation (a

Q63: In the current year, Plum Corporation, a

Q65: Which of the following statements is correct

Q65: Which of the following statements is incorrect

Q66: During 2012, Sparrow Corporation, a calendar year

Q70: During the current year, Owl Corporation (a

Q76: George Judson is the sole shareholder and

Q77: Which of the following statements is incorrect

Q78: During the current year, Violet, Inc., a

Q80: Copper Corporation owns stock in Bronze Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents