Tiva Solutions’ accounting records reflect the following account balances at December 31, 2017:

During 2017, the following transactions occurred:

1. On March 1, purchased a one-year insurance policy for $1,200 cash.

2. On April 1, borrowed $10,000 cash from Rock City Bank. The interest rate on the note payable is 6%.

Principal and interest is due in cash in one year.

3. Employee salaries in the amount of $20,000 were paid in cash.

4. At the end of the year, $400 of the supplies remained on hand.

5. Earned $45,000 in tax consulting revenue during 2017 in cash.

6. At December 31, $5,000 in employee salaries were accrued.

7. On December 31, received $2,000 in cash representing advance payment for services to be provided in February 2018.

8. The building has a useful life of 25 years and no salvage value.

The building has a useful life of 25 years and no salvage value.

Required

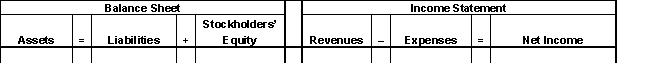

A. Determine the effect on the accounting equation of the preceding transactions including any related year-end adjusting entries that may be required. Create a table to reflect the increases and decreases in accounts.

B. Prepare an income statement for Tiva Solutions for 2017. Ignore income tax effects.

B. Prepare an income statement for Tiva Solutions for 2017. Ignore income tax effects.

C. Prepare a classified balance sheet for Tiva Solutions at December 31, 2017.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: Fennel Flooring purchased office supplies for

Q184: The following unadjusted amounts were taken

Q185: Scenic View Foods Corporation

The following consolidated statements

Q186: At the end of 2017,the unadjusted

Q187: Marcus Roberts operates a small retail

Q189: Given below are the amounts from

Q190: Lowen Homes,Inc.pays its sales personnel 6% commission

Q191: Martinez Produce sells fresh vegetables and

Q192: The following unadjusted amount was reported

Q193: Scenic View Foods Corporation

The following consolidated statements

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents