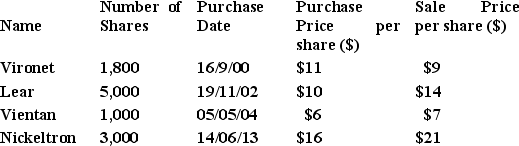

From the previous question, Belinda omitted to advise you that she also has some capital gains tax information arising from shares she had sold in the 2014 financial year. In addition, Belinda also forgot to tell you that she has a carry forward capital loss as at the start of the 2014 financial year of $3,700. All the shares listed below were sold on the 19th March 2014 with the remaining relevant capital gains tax information as follows:

a) Calculate the 2014 net taxable capital gain / loss for Belinda.

a) Calculate the 2014 net taxable capital gain / loss for Belinda.

b) Calculate Belinda's adjusted 2014 taxable income.

c) Calculate Belinda's adjusted 2014 net tax payable / refund including the medicare levy and any low income tax offset.

d) Calculate the overall change in 2014 tax liability as a result of the additional information provided by Belinda.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Appropriate income splitting strategies for taxation purposes

Q17: Where a company has paid no Australian

Q18: Examples of income tax offsets in Australia

Q19: In Australia, the maximum marginal income tax

Q20: Income tax is imposed on a taxpayer's:

A)

Q21: As an experienced financial adviser with a

Q22: Mr Brady Chambers has approached you for

Q23: Positive and negative gearing are alternative taxation

Q24: As a taxation and financial expert, what

Q25: Companies are often used by taxpayers seeking

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents