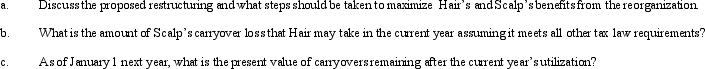

Present Value Tables needed for this question.Hair Corporation would like to acquire Scalp Corporation on August 31 because Scalp has an $8,000 capital loss carryover and $32,200 of general business credits that Hair could readily use.At this time,Scalp has assets valued at $1 million (basis of $1.1 million).While Hair is not interested in having Scalp's shareholders become its shareholders,it is interested in expanding into Scalp's business line.Hair thinks it could turn Scalp around with up-to-date equipment.Thus,Hair would like to sell Scalp's assets immediately,recognize the loss to offset its expected gains,and then use the proceeds to purchase new equipment.Hair is a very profitable corporation and is also expecting to have at least $50,000 of capital gains and $3 million in other income for the current year.Hair is proposing paying cash for all of Scalp's assets and liabilities.The Federal long-term tax-exempt rate is currently 3%,and Hair's discount factor for making investment decisions is 15%.

Correct Answer:

Verified

Q63: Explain whether shareholders are exempted from gain/loss

Q65: Discuss the role of letter rulings in

Q67: What will cause the corporations involved in

Q68: There are several different types of corporate

Q104: Discuss the influence of step transaction,sound business

Q106: Present Value Tables needed for this question.Sauce

Q110: On March 1,Cream Corporation transfers all of

Q111: Tin Corporation was created 10 years ago.It

Q111: Compare an acquisitive "Type D" reorganization with

Q122: Discuss the treatment of accumulated earnings and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents