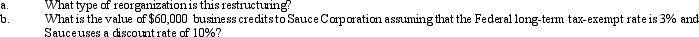

Present Value Tables needed for this question.Sauce Corporation is very interested in acquiring a controlling interest Pear Corporation,to obtain operating efficiencies.Sauce currently owns 30% of Pear,which it bought six years ago for $600,000.Sauce is a fruit processor with assets valued at $3 million and liabilities of $1 million.Pear supplies Sauce with fruit from its orchards that are valued at $4 million with $3 million in mortgages.Pear also has $60,000 in unused general business credits.Sauce has negotiated a restructuring with most of Pear's shareholders.It will exchange 1 share of its stock for 2 shares of Pear.Pear's founder,who own 10% of the outstanding common stock,is not willing to relinquish her stock and thus,Sauce cannot own 100% of Pear.

Correct Answer:

Verified

Q65: Discuss the role of letter rulings in

Q67: What will cause the corporations involved in

Q68: There are several different types of corporate

Q102: Gera owns 25,000 shares of Flow Corporation's

Q104: Discuss the influence of step transaction,sound business

Q106: Provide the formula for the § 382

Q108: Present Value Tables needed for this question.Hair

Q110: On March 1,Cream Corporation transfers all of

Q111: Tin Corporation was created 10 years ago.It

Q122: Discuss the treatment of accumulated earnings and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents