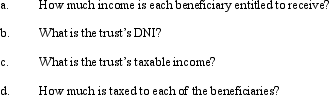

Counsell is a simple trust that correctly uses the calendar year for tax purposes.Its income beneficiaries (Kathie,Lynn,Mark,and Norelle)are entitled to the trust's annual accounting income in shares of one-fourth each.For the current calendar year,the trust has ordinary business income of $40,000,a long-term capital gain of $20,000 (allocable to income),and a trustee commission expense of $4,000 (allocable to corpus).Use the format of Figure 20.3 in the text to address the following items.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Your client Ming is a complex trust

Q126: Is a trust subject to the alternative

Q133: Consider the term distributable net income as

Q134: Bob is one of the income beneficiaries

Q134: Marcus has been determined to be a

Q135: List at least three non-tax reasons that

Q135: The Gomez Trust is required to distribute

Q146: Consider the term fiduciary accounting income as

Q147: Tax professionals use the terms simple trust

Q151: Identify the parties that are present when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents