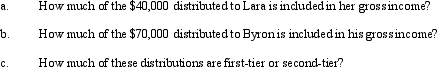

The Gomez Trust is required to distribute $80,000 annually,split equally between its two income beneficiaries,Lara and Byron.If trust income is not sufficient to pay these amounts,the trustee can invade corpus to the extent necessary.During the current year,the trust has DNI of $60,000.Byron receives an additional $30,000 discretionary corpus distribution.

Correct Answer:

Verified

Q126: Is a trust subject to the alternative

Q131: The trustee of the Miguel Trust can

Q134: Bob is one of the income beneficiaries

Q134: The Raja Trust operates a welding business.

Q135: List at least three non-tax reasons that

Q138: Counsell is a simple trust that correctly

Q140: The Circle Trust has some exempt interest

Q146: Consider the term fiduciary accounting income as

Q147: Tax professionals use the terms simple trust

Q151: Identify the parties that are present when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents