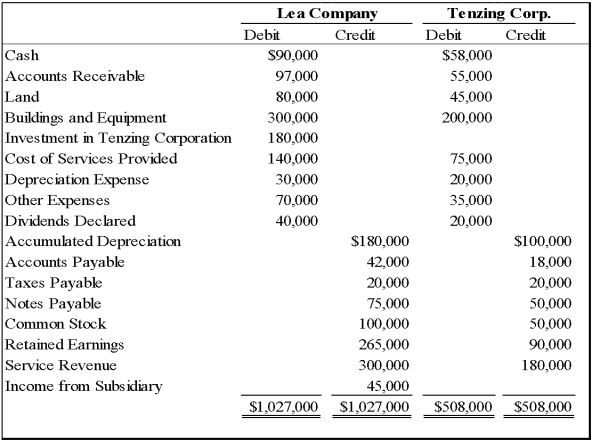

Lea Company acquired all of Tenzing Corporation's stock on January 1, 20X6 for $150,000 cash. On December 31, 20X8, the trial balances of the two companies were as follows:

Tenzing Corporation reported retained earnings of $75,000 at the date of acquisition. The difference between the acquisition price and underlying book value is assigned to buildings and equipment with a remaining economic life of five years from the date of acquisition. At December 31, 20X8, Tenzing owed Lea $4,000 for services provided.

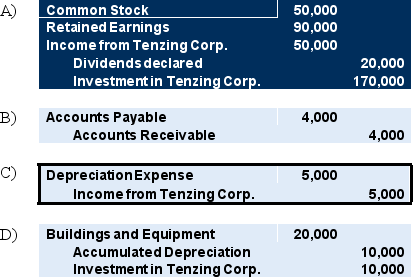

-Based on the preceding information,all of the following are consolidating entries required on December 31,20X8,to prepare consolidated financial statements,except:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q34: On December 31,20X8,Polaris Corporation acquired 100 percent

Q37: On December 31,20X8,Polaris Corporation acquired 100 percent

Q47: Berlin, Inc. holds 100 percent of the

Q48: Plant Company acquired all of Sprout Corporation's

Q51: Plant Company acquired all of Sprout Corporation's

Q51: Berlin, Inc. holds 100 percent of the

Q52: On January 1,20X8,Blake Company acquired all of

Q55: On December 31,20X1,Pine Corporation acquired 100 percent

Q56: Plant Company acquired all of Sprout Corporation's

Q57: On January 1,20X9,Paradox Company acquired all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents