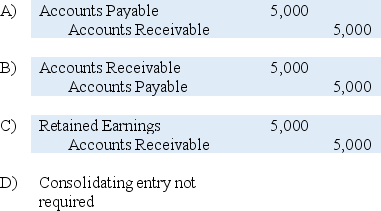

On January 1,20X8,Blake Company acquired all of Frost Corporation's voting shares for $280,000 cash.On December 31,20X9,Frost owed Blake $5,000 for services provided during the year.When consolidated financial statements are prepared for 20X9,which entry is needed to eliminate intercompany receivables and payables in the consolidation worksheet?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q37: On December 31,20X8,Polaris Corporation acquired 100 percent

Q42: Which of the following observations is NOT

Q47: Berlin, Inc. holds 100 percent of the

Q48: Plant Company acquired all of Sprout Corporation's

Q50: Lea Company acquired all of Tenzing Corporation's

Q51: Berlin, Inc. holds 100 percent of the

Q51: Plant Company acquired all of Sprout Corporation's

Q56: Plant Company acquired all of Sprout Corporation's

Q57: On January 1,20X9,Paradox Company acquired all of

Q58: On January 1,20X9,Paradox Company acquired all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents