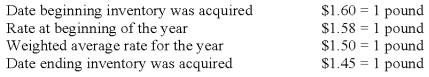

The British subsidiary of a U.S.company reported cost of goods sold of 75,000 pounds (sterling) for the current year ended December 31.The beginning inventory was 10,000 pounds,and the ending inventory was 15,000 pounds.Spot rates for various dates are as follows:  Assuming the dollar is the functional currency of the British subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is:

Assuming the dollar is the functional currency of the British subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is:

A) $108,750.

B) $112,500.

C) $114,250.

D) $125,700.

Correct Answer:

Verified

Q42: South Company is a subsidiary of Pole

Q56: South Company is a subsidiary of Pole

Q61: Gains from remeasuring a foreign subsidiary's financial

Q62: Briefly explain the following terms associated with

Q63: Which of the following describes a situation

Q65: On January 1,2008,Pace Company acquired all of

Q67: Parisian Co.is a French company located in

Q68: Mercury Company is a subsidiary of Neptune

Q70: On January 1,2008,Pace Company acquired all of

Q71: The Canadian subsidiary of a U.S.company reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents