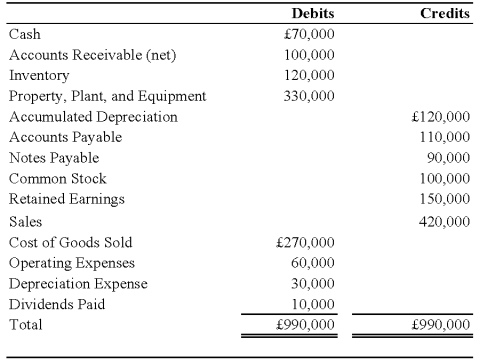

On January 1,2008,Pace Company acquired all of the outstanding stock of Spin PLC,a British Company,for $350,000.Spin's net assets on the date of acquisition were 250,000 pounds (£).On January 1,2008,the book and fair values of the Spin's identifiable assets and liabilities approximated their fair values except for property,plant,and equipment and trademarks.The fair value of Spin's property,plant,and equipment exceeded its book value by $25,000.The remaining useful life of Spin's equipment at January 1,2008,was 10 years.The remainder of the differential was attributable to a trademark having an estimated useful life of 5 years.Spin's trial balance on December 31,2008,in pounds,follows:

Additional Information

1.Spin uses the FIFO method for its inventory.The beginning inventory was acquired on December 31,2007,and ending inventory was acquired on December 26,2008.Purchases of £300,000 were made evenly throughout 2008.

2.Spin acquired all of its property,plant,and equipment on March 1,2006,and uses straight-line depreciation.

3.Spin's sales were made evenly throughout 2008,and its operating expenses were incurred evenly throughout 2008.

4.The dividends were declared and paid on November 1,2008.

5.Pace's income from its own operations was $150,000 for 2008,and its total stockholders' equity on January 1,2008,was $1,000,000.Pace declared $50,000 of dividends during 2008.

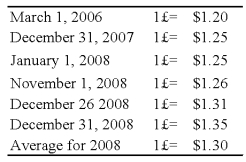

6.Exchange rates were as follows:

Assume the U.S.dollar is the functional currency,not the pound.

Required:

1)Prepare a schedule remeasuring the trial balance from British pound into U.S.dollars.

2)Assume that Pace uses the fully adjusted equity method.Record all journal entries that relate to its investment in the British subsidiary during 2008.Provide the necessary documentation and support for the amounts in the journal entries.

3)Prepare a schedule that determines Pace's consolidated net income for 2008.

Problem 75 (continued):

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: South Company is a subsidiary of Pole

Q56: South Company is a subsidiary of Pole

Q60: Which combination of accounts and exchange rates

Q61: Gains from remeasuring a foreign subsidiary's financial

Q62: Briefly explain the following terms associated with

Q63: Which of the following describes a situation

Q66: The British subsidiary of a U.S.company reported

Q67: Parisian Co.is a French company located in

Q68: Mercury Company is a subsidiary of Neptune

Q70: On January 1,2008,Pace Company acquired all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents