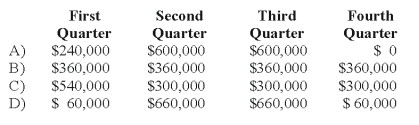

Mason Company paid its annual property taxes of $240,000 on February 15,20X9.Mason also anticipates that its annual repairs expense for 20X9 will be $1,200,000.This amount is usually incurred and paid in July and August when operations are shut down so that machinery and equipment can be repaired.What amount should Mason deduct for property taxes and repairs in each quarter for 20X9?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q24: Forge Company,a calendar-year entity,had 6,000 units in

Q25: On March 15,20X7,Barrel Company paid property taxes

Q28: On June 30,20X8,String Corporation incurred a $220,000

Q34: On March 15,20X9,Clarion Company paid property taxes

Q38: Samuel Corporation foresees a downturn in its

Q40: On June 30,20X0,Bow Corporation incurred a $150,000

Q50: Toledo Imports,a calendar-year corporation,had the following income

Q51: Derby Company pays its executives a bonus

Q52: Fisher Company pays its executives a bonus

Q52: Denver Company,a calendar-year corporation,had the following actual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents