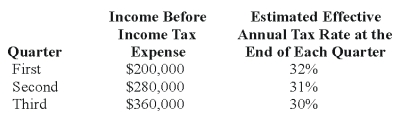

Toledo Imports,a calendar-year corporation,had the following income before tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:  Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

A) $250,800 and $103,200.

B) $252,000 and $108,000.

C) $252,000 and $103,200.

D) $250,800 and $108,000.

Correct Answer:

Verified

Q24: Forge Company,a calendar-year entity,had 6,000 units in

Q25: On March 15,20X7,Barrel Company paid property taxes

Q28: On June 30,20X8,String Corporation incurred a $220,000

Q33: Forge Company,a calendar-year entity,had 6,000 units in

Q34: On March 15,20X9,Clarion Company paid property taxes

Q40: On June 30,20X0,Bow Corporation incurred a $150,000

Q51: Mason Company paid its annual property taxes

Q51: Derby Company pays its executives a bonus

Q52: Fisher Company pays its executives a bonus

Q52: Denver Company,a calendar-year corporation,had the following actual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents