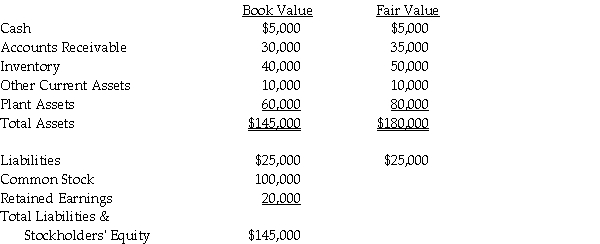

On January 1, 2011, Gregory Company acquired a 90% interest in Subway Company for $200,000 cash.On January 1, 2011, Subway Company had the following assets and liabilities:

The plant assets have 20 years of useful life remaining.Straight-line depreciation is used.The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2011.

The plant assets have 20 years of useful life remaining.Straight-line depreciation is used.The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2011.

In 2011, Subway reported net income of $35,000 and declared and paid common dividends of $10,000.Gregory reported Income from Subway in 2011 of $17,100.

Required:

Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers for the year ending December 31, 2011.

Correct Answer:

Verified

Q27: Which of the following statements about variable

Q31: Under push-down accounting,the _ of the acquired

Q31: On January 1, 2011, Jeff Company acquired

Q32: Partridge Corporation purchased an 80% interest in

Q33: Pashley Corporation purchased 75% of Sargent Corporation

Q34: On January 1, 2011, Jennifer Company acquired

Q36: On January 1, 2011, Brody Company acquired

Q37: Party Corporation acquired an 80% interest in

Q39: On January 1, 2011, Penny Company acquired

Q40: Patane Corporation acquired 80% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents