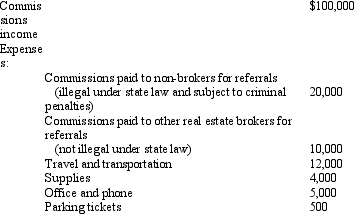

Angela,a real estate broker,had the following income and expenses in her business:  How much net income must Angela report from this business?

How much net income must Angela report from this business?

A) $48,500.

B) $49,000.

C) $60,000.

D) $68,500.

E) $69,000.

Correct Answer:

Verified

Q66: Which of the following are deductions for

Q69: Payments by a cash basis taxpayer of

Q71: Which of the following is deductible as

Q75: Iris,a calendar year cash basis taxpayer,owns and

Q77: Terry and Jim are both involved in

Q77: Which of the following is not a

Q81: Bob and April own a house at

Q84: Which of the following must be capitalized

Q91: Which of the following statements is correct?

A)If

Q93: Nikeya sells land (adjusted basis of $120,000)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents