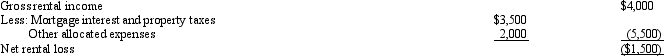

Bob and April own a house at the beach.The house was rented to unrelated parties for 8 weeks during the year.April and the children used the house 12 days for their vacation during the year.After properly dividing the expenses between rental and personal use,it was determined that a loss was incurred as follows:  What is the correct treatment of the rental income and expenses on Bob and April's joint income tax return for the current year assuming the IRS approach is used if applicable?

What is the correct treatment of the rental income and expenses on Bob and April's joint income tax return for the current year assuming the IRS approach is used if applicable?

A) A $1,500 loss should be reported.

B) Only the mortgage interest and property taxes should be deducted.

C) Since the house was used more than 10 days personally by Bob and April, the rental expenses (other than mortgage interest and property taxes) are limited to the gross rental income in excess of deductions for interest and taxes allocated to the rental use.

D) Since the house was used less than 50% personally by Bob and April, all expenses allocated to personal use may be deducted.

E) Bob and April should include none of the income or expenses related to the beach house in their current year income tax return.

Correct Answer:

Verified

Q66: Which of the following are deductions for

Q71: Which of the following is deductible as

Q77: Which of the following is not a

Q77: Terry and Jim are both involved in

Q79: Angela,a real estate broker,had the following income

Q82: Which of the following is relevant in

Q84: Which of the following must be capitalized

Q86: Cory incurred and paid the following expenses:

Q91: Which of the following statements is correct?

A)If

Q93: Nikeya sells land (adjusted basis of $120,000)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents