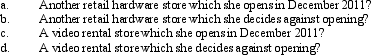

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2011 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2011 if the business is:

Correct Answer:

Verified

Q108: During the year,Larry rented his vacation home

Q111: During the year,Martin rented his vacation home

Q112: The salaries of the top eight executives

Q114: Sandra owns an insurance agency.The following selected

Q115: Calculate the net income includible in taxable

Q117: While she was a college student,Juliet worked

Q118: Edward operates an illegal drug-running business and

Q119: In order to protect against rent increases

Q120: Kitty runs a brothel (illegal under state

Q136: Bruce owns several sole proprietorships. Must Bruce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents