During the year,Martin rented his vacation home for three months and spent one month there.Gross rental income from the property was $5,000.Martin incurred the following expenses: mortgage interest,$3,000; real estate taxes,$1,500; utilities,$800; maintenance,$500; and depreciation,$4,000.Compute Martin's allowable deductions for the vacation home.

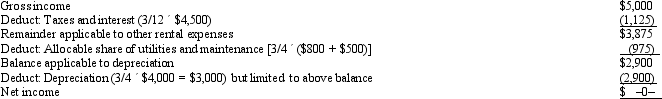

Since the vacation home is rented for 15 or more days and is used for personal purposes for more than the greater of (1)14 days or (2)10% of the rental days,the deductions are scaled down,using the court's approach,as follows:

Thus,Martin may deduct $1,125 taxes and interest,$975 utilities and maintenance,and $2,900 depreciation against the gross income of $5,000.The personal portion of taxes and interest ($3,375)is deductible as an itemized deduction.Example 29

Thus,Martin may deduct $1,125 taxes and interest,$975 utilities and maintenance,and $2,900 depreciation against the gross income of $5,000.The personal portion of taxes and interest ($3,375)is deductible as an itemized deduction.Example 29

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Beige, Inc., an airline manufacturer, is conducting

Q107: Taylor,a cash basis architect,rents the building in

Q108: Alton sells land with an adjusted basis

Q108: During the year,Larry rented his vacation home

Q109: Bridgett's son,Hubert,is $6,000 in arrears on his

Q110: Mattie and Elmer are separated and are

Q112: The salaries of the top eight executives

Q114: Sandra owns an insurance agency.The following selected

Q115: Calculate the net income includible in taxable

Q116: Gladys owns a retail hardware store in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents