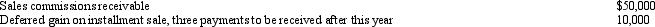

Bob is one of the income beneficiaries of the LaQuanda Estate,which is subject to a 45% marginal Federal estate tax rate,a 35% marginal Federal income tax rate,and a 5% marginal state income tax rate.This year,Bob received all of the sales commissions that were earned and payable to Lulu LaQuanda (cash basis)at her death.Compute Bob's § 691(c)deduction for the current year,given the following data.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: The IRS encourages _ filing for Forms

Q105: The Cooper Trust is required to distribute

Q107: _ is the maximum amount that can

Q110: The Booker Trust is your client.Complete the

Q111: The LMN Trust is a simple trust

Q112: A fiduciary's _ deductions are assigned corresponding

Q119: A _ tier distribution is one that

Q120: Beneficiary information concerning a trust's income and

Q120: A fiduciary assigns its tax credits to

Q134: The Raja Trust operates a welding business.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents