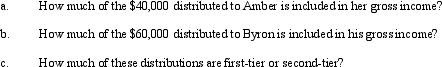

The Cooper Trust is required to distribute $80,000 annually,split equally between its two income beneficiaries,Amber and Byron.If trust income is not sufficient to pay these amounts,the trustee can invade corpus to the extent necessary.During the current year,the trust has DNI of $50,000.Byron receives an additional $20,000 discretionary corpus distribution.

Correct Answer:

Verified

Q89: A fiduciary arrangement creates a separate tax

Q104: The IRS encourages _ filing for Forms

Q107: _ is the maximum amount that can

Q108: Bob is one of the income beneficiaries

Q110: The Booker Trust is your client.Complete the

Q116: Income beneficiary Molly wants to receive all

Q117: The deduction for the Goodman Trust's $100,000

Q120: A fiduciary assigns its tax credits to

Q120: Beneficiary information concerning a trust's income and

Q134: The Raja Trust operates a welding business.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents